Private Equity Buying Homes: Full Guide, Benefits, Risks, and Top Tools for Investors

The rise of private equity buying homes has reshaped the residential property market. What once was a domain for small independent landlords has now become a competitive landscape where large institutional investors, private equity firms, hedge funds, and real estate investment groups buy homes at scale. This shift brings new opportunities, challenges, and strategies for both investors and homeowners.

Private equity firms purchase residential homes to generate rental income, appreciation, and portfolio diversification. Backed by large pools of capital, they can move quickly, buy in bulk, and leverage advanced data analytics to identify profitable opportunities. For individual investors, understanding this trend is crucial to determining whether to compete, collaborate, or adopt similar strategies using modern real estate technology.

This guide explains how private equity firms buy homes, why the strategy works, the tools they use, and how everyday investors can apply similar techniques.

Understanding Why Private Equity Firms Are Buying Homes

Private equity firms target residential properties for three main reasons: long-term stability, persistent rental demand, and scalable investment returns. Housing markets offer consistent appreciation, while rentals generate steady cash flow regardless of broader market volatility.

Private equity groups do not rely on guesswork. Instead, they use advanced analytics, forecasting tools, and transaction automation to outcompete traditional buyers. These firms often acquire portfolios of single-family homes, renovate them, and rent them out under professional management systems.

For individual investors, learning these strategies and the technology behind them can dramatically increase portfolio performance.

Core Private Equity Housing Investment Strategies

Bulk Acquisition Strategy

Private equity firms often purchase homes in bulk either from developers, distressed sellers, or through foreclosure auctions. By buying dozens or hundreds of units at once, they reduce acquisition costs and streamline management operations.

This approach requires detailed market data, financial modeling, and highly efficient transaction systems. Modern tools allow firms to evaluate rental return, renovation costs, and location trends across thousands of homes quickly.

Single-Family Rental (SFR) Portfolio Strategy

The fastest-growing sector in private equity real estate is single-family rentals. These homes offer higher yields, predictable tenants, and long-term asset appreciation.

Private equity firms buy homes, renovate them to a uniform standard, and use professional management technology to oversee rent collection, maintenance, and tenant screening. This model makes the portfolio scalable and more profitable.

Data-Driven Market Optimization

Private equity does not choose markets randomly. They rely on forecasting models to target cities with:

• strong population growth

• rising rents

• low inventory supply

• high job creation

• favorable landlord laws

This analytical approach is now available to smaller investors through new real estate platforms, which we will explore below.

Top 5 Real-World Tools Used in Private Equity Home Buying

Below are five powerful tools used across the real estate industry. Each section includes:

• Insert image of the product

• Expanded information

• Benefits

• Use cases

• Buying guidance with a link

• No tables

DealPath – Real Estate Deal Pipeline Software

DealPath is a transaction and pipeline management platform used by private equity firms to streamline acquisitions. It centralizes deal flow, financial modeling, property analysis, and team collaboration. For large investors evaluating hundreds of properties, DealPath reduces manual tasks and minimizes errors.

The platform allows firms to score deals, manage due diligence, store documents, and automate workflows across acquisition teams. Individual investors can use it to adopt institutional-level discipline in property selection and documentation.

Benefits of Using DealPath

DealPath improves accuracy and speeds up decision-making by consolidating financial data and deal metrics in one interface. Investors benefit from reduced risk, faster turnaround times, and more transparent project tracking.

Use Cases

• Evaluating hundreds of properties and shortlisting those with the highest ROI

• Managing financial modeling, due diligence, and renovation projections

• Tracking team collaboration during large portfolio acquisitions

Yardi Matrix – Institutional-Grade Real Estate Data

Yardi Matrix provides deep real estate market intelligence, including rent trends, occupancy levels, demographic analysis, property sales history, and market forecasts. Private equity firms rely on this tool when choosing which cities or neighborhoods to invest in.

Its data engine includes over 20 years of historical property performance, making it invaluable for long-term strategic planning.

Benefits of Using Yardi Matrix

The system’s historical database helps investors accurately predict rental value, cap rate changes, and market cycles. It reduces risks by providing factual insights instead of assumptions.

Use Cases

• Identifying high-growth rental markets

• Performing long-term investment forecasting

• Comparing cities for SFR portfolio expansion

Roofstock – Marketplace for Single-Family Rental Homes

Roofstock is a leading marketplace where individuals and institutions can purchase rental properties, many of which already have tenants. This platform is especially important for private equity firms building large rental portfolios.

Each listing includes rent rolls, inspection reports, cap rate metrics, and neighborhood ratings.

Benefits of Using Roofstock

Roofstock streamlines acquisitions by offering turnkey rental properties that begin earning income immediately. Investors minimize downtime and avoid the complexities of tenant placement.

Use Cases

• Buying single-family rentals with existing tenants

• Evaluating turnkey properties with pre-built financial projections

• Building multi-market rental portfolios

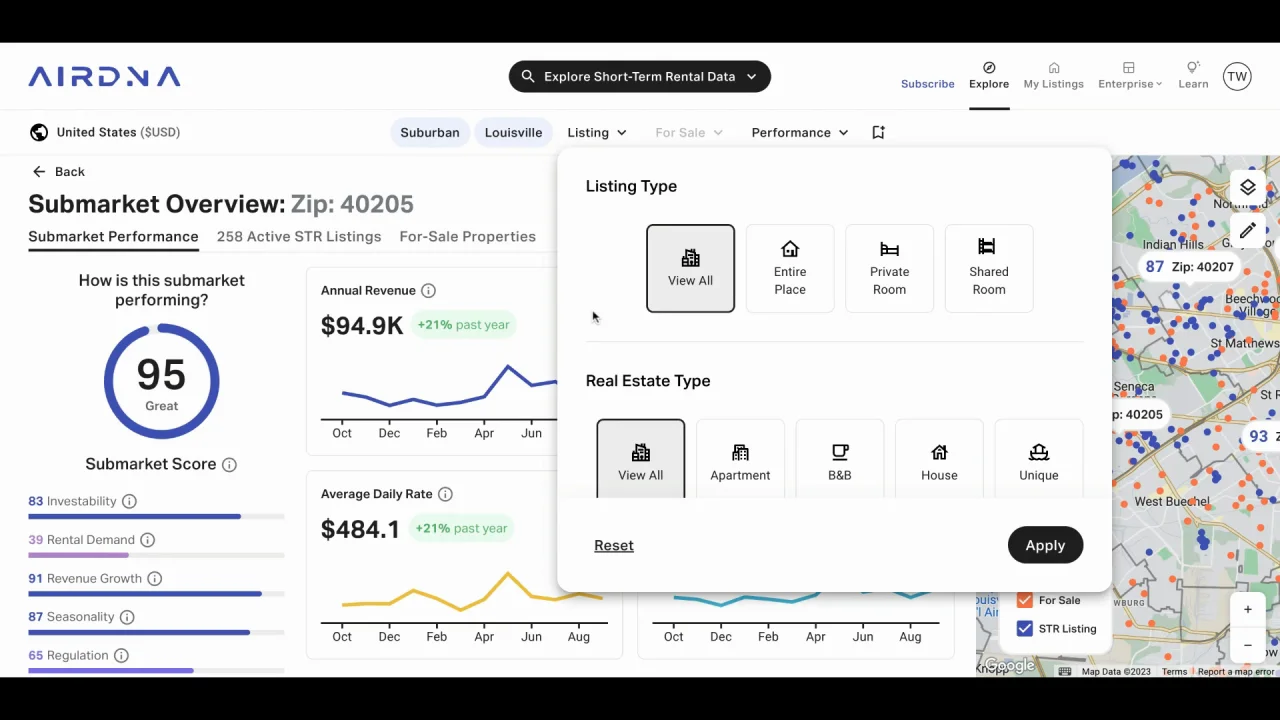

AirDNA – Short-Term Rental Performance Analytics

AirDNA offers market data for Airbnb and vacation rentals. Private equity investors use it when evaluating short-term rental markets, pricing strategies, and seasonal income potential.

Its dashboards display occupancy rates, average daily rates, revenue forecasts, and neighborhood competitiveness.

Benefits of Using AirDNA

AirDNA helps investors identify top-performing STR regions and build revenue strategies backed by real data. This reduces risk and maximizes occupancy.

Use Cases

• Deciding whether a home should be a short-term or long-term rental

• Forecasting seasonal rental income

• Planning high-yield renovation improvements

Stessa – Rental Property Accounting & Management

Stessa is a financial management and property tracking platform used by investors with large rental portfolios. It automates income tracking, expense categorization, tax reporting, and property performance dashboards.

Private equity operators use similar software for transparent reporting and optimizing returns.

Benefits of Using Stessa

Stessa simplifies accounting work and keeps detailed records of cash flow, renovation costs, and tax-deductible expenses. This saves time and improves portfolio profitability.

Use Cases

• Tracking financial performance across multiple homes

• Automating tax reporting for investment properties

• Monitoring rental deposits, maintenance, and expenses

How Private Equity Buying Homes Affects Individual Investors

Private equity participation impacts the market in several ways. For everyday buyers and small investors, it increases competition in desirable neighborhoods. However, it also creates opportunities through partnership models, fractional investing, or buying in markets not yet targeted by institutions.

Smaller investors can also adopt the data-driven strategies used by private equity. With modern technology such as DealPath, Yardi Matrix, and Roofstock, individuals can make decisions with institutional-grade confidence.

Benefits of Adopting Private Equity Strategies for Individual Investors

More Accurate Deal Analysis

Using institutional tools allows individual investors to avoid emotional decision-making and rely on financial accuracy.

Reduced Risk Through Data

Forecasting models help investors avoid overpriced properties and low-performing markets.

Scalable Portfolio Growth

Technology automates management and allows investors to expand more efficiently.

Choosing the Best Approach for Your Real Estate Investment Goals

Selecting the right strategy depends on:

• your capital

• time availability

• risk tolerance

• preferred markets

• return expectations

Private equity models can guide individual investors toward smarter purchasing decisions and long-term wealth generation.

Frequently Asked Questions (FAQs)

1. Why are private equity firms buying so many homes?

Residential properties provide stable rental income, strong appreciation, and recession-resistant performance. Private equity firms also have access to large capital pools, enabling them to buy at scale.

2. Is private equity buying homes bad for regular homebuyers?

It does increase competition, especially in hot markets. However, it also increases rental availability, and individuals can still compete by using the same analytics tools private equity uses.

3. Can individual investors use the same tools as private equity?

Yes. Platforms like DealPath, Roofstock, AirDNA, and Stessa provide institutional-grade data and management features accessible to everyday investors.