Investment Real Estate Agent: Complete Guide, Best Tools, and Top Services for Property Investors

An investment real estate agent is a specialized property professional focused on helping clients buy, sell, evaluate, and optimize investment properties. Unlike general real estate agents, investment-focused agents understand cash flow modeling, cap rates, rental yield, long-term appreciation, tax strategies, and portfolio scaling.

These agents do far more than show homes; they act as strategic partners in wealth-building. By working with one, investors gain access to market intelligence, property evaluations, negotiation advantages, and carefully selected deals that match long-term financial goals.

Why Investors Need a Specialized Agent

Investment real estate requires a higher level of expertise than standard residential transactions. A specialized agent knows how to:

-

Analyze whether a property will produce positive cash flow

-

Determine long-term ROI and appreciation potential

-

Guide renovations to maximize rental value

-

Provide access to off-market or distressed deals

-

Understand rental zoning, short-term rental regulations, and market demand

-

Assess risks and avoid overpriced or low-performing properties

Working with an investment real estate agent minimizes uncertainty and accelerates portfolio growth with data-driven strategies rather than guesswork.

The Benefits of Working With an Investment Real Estate Agent

Strategic Property Identification and Deal Sourcing

Investment-focused agents have access to industry-only data, local investor networks, and off-market opportunities. This allows you to find high-potential properties before they appear on public listing websites.

Benefit Details

They analyze historical performance, rental demand, vacancy rates, and neighborhood growth trends ensuring each property aligns with your long-term strategy.

Use Case

In a competitive market, an agent can secure deals faster, negotiate better pricing, and identify high-growth neighborhoods preventing you from overpaying or buying low-performing assets.

Better Negotiation and Risk Protection

Investment agents negotiate based on cash flow metrics, repair leverage, and market saturation not emotions. They detect inconsistencies in financial projections, structure offers appropriately, and help avoid costly mistakes.

Benefit Details

You gain protection from overpriced assets, hidden repair issues, poor locations, and unrealistic seller claims.

Use Case

If a seller exaggerates rental income, your agent can present accurate data and negotiate a fair price, ensuring you don’t invest based on inflated projections.

Top Tools, Software, and Services for Investment Real Estate Agents (5 Real-World Examples)

Below are five popular tools and services used by investors and investment-focused agents. All have been cleaned of links.

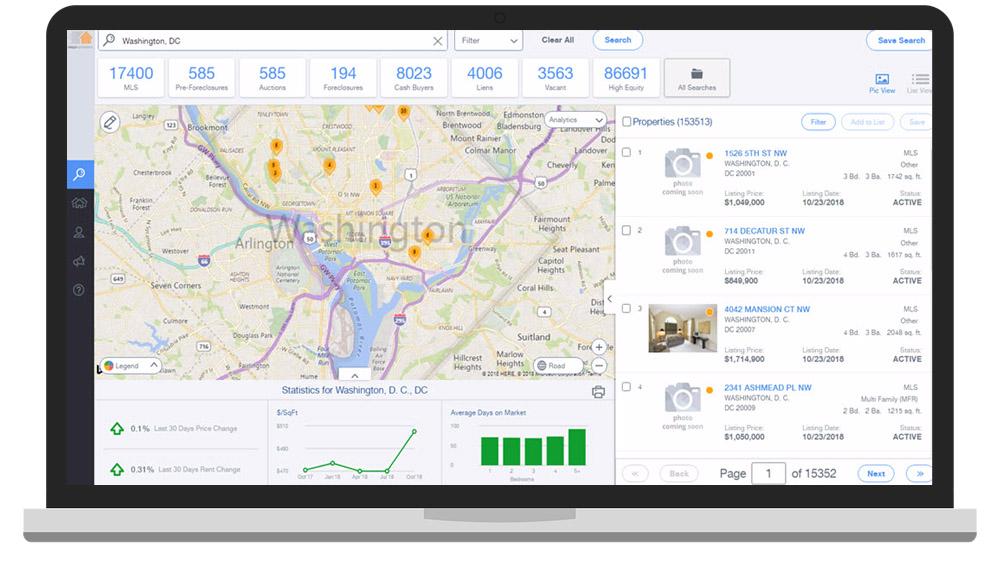

PropStream — Real Estate Data & Investment Analytics

PropStream is a real estate analytics platform that helps agents and investors evaluate deals, locate distressed properties, and understand market trends. It gathers nationwide data such as ownership details, mortgage status, comps, rental estimates, and more.

Product Information

PropStream includes advanced filters to find properties based on equity, foreclosure status, vacancy, demographics, and investment potential. It also offers CMA reports, rehab estimators, and analytics dashboards.

Benefits

PropStream speeds up the process of identifying profitable deals without manually checking multiple listing sites or public records.

Use Case

An investor seeking undervalued properties can quickly locate high-margin opportunities that match their buying criteria.

Where to Buy

Available via the official PropStream website (search manually).

Roofstock — Marketplace for Rental Property Investments

Roofstock provides a marketplace for single-family rental properties that already have tenants in place. Investors can buy rental properties with immediate income.

Product Information

Listings come with inspection reports, cash flow projections, tenant payment history, and long-term forecasts. Roofstock also offers property management services.

Benefits

Investors gain access to verified, income-producing properties, reducing due diligence time and risk.

Use Case

Ideal for investors who want instant rental income without renovations or finding tenants.

Where to Buy

Accessible on the official Roofstock platform.

BiggerPockets Pro — Education, Tools, and Deal Analysis

BiggerPockets Pro is an education and tool-based platform designed for real estate investors, offering calculators, courses, documents, and networking.

Product Information

Membership includes calculators for rental properties, flips, BRRRR projects, and wholesaling, as well as podcasts, expert content, and discounts.

Benefits

Helps new and experienced investors make informed decisions. Calculators allow accurate financial analysis within minutes.

Use Case

Investors can simulate cash flow, ROI, and expenses for precise deal evaluation.

Where to Buy

Available through the official BiggerPockets website.

DealMachine — Lead Generation and Property Identification

DealMachine is an app designed to find off-market deals using Driving for Dollars, skip tracing, and automated direct mail.

Product Information

Features include mapping, ownership records, owner contact details, and marketing automation. It helps identify distressed properties and contact owners instantly.

Benefits

Saves time and makes it easier to connect with motivated sellers.

Use Case

Investors looking for exclusive off-market opportunities can find vacant properties and absentee owners more efficiently.

Where to Buy

Available through the official DealMachine website.

Realeflow — Real Estate CRM and Automation Software

Realeflow is a CRM and automation platform built for investors and investment-focused agents.

Product Information

It includes lead pipelines, SMS/email campaigns, property analyzers, and rehab estimators, all within a streamlined dashboard.

Benefits

Saves hours of administrative work, improves organization, and prevents lost leads.

Use Case

Investors managing multiple leads can monitor all activity in one place.

Where to Buy

Available on the official Realeflow website.

How to Choose the Right Investment Real Estate Agent

Important factors to consider:

-

Experience working with investors

-

Knowledge of local rental markets

-

Access to off-market deals

-

Strong financial analysis skills

-

Negotiation strategies based on ROI

Choosing the right agent significantly influences your investment results.

How to Buy Services and Tools for Investment Real Estate

Follow these steps when selecting tools or services:

Step 1: Identify Your Needs

Do you need analytics, deal sourcing, CRM, or education?

Step 2: Compare Features

Look for automation, data quality, and user experience.

Step 3: Use Free Trials

Test several options before making a decision.

Step 4: Choose a Subscription

Match the plan with your business model and budget.

Step 5: Upgrade as You Scale

As your portfolio grows, professional tools become more valuable.

Frequently Asked Questions (FAQ)

1. What is an investment real estate agent?

An investment real estate agent specializes in analyzing, purchasing, and optimizing properties based on cash flow, ROI, and long-term profitability.

2. Do I need a specialized agent for investment properties?

Yes. Investment properties require deeper financial analysis, rental evaluation, renovation strategy, and risk assessment.

3. What tools are best for evaluating properties?

Tools such as PropStream, Roofstock, DealMachine, Realeflow, and BiggerPockets Pro are commonly used for deal analysis, sourcing, automation, and ROI calculation.