Best Property Investment Strategies for Maximum ROI: Complete Guide + Tools

Property investment strategies are essential for investors who want to build passive income streams, grow long-term equity, and create sustainable wealth. Whether you are a beginner or a seasoned investor, choosing the right strategy significantly influences your overall profitability. In today’s market, property investment requires a data-driven approach, automation technology, and accurate analysis tools to minimize risks and optimize decision-making.

In simple terms, a property investment strategy is a structured plan that outlines how you will purchase, manage, finance, and sell properties to meet your financial goals. Each strategy carries a different level of risk, required capital, and expected return. Successful investors leverage modern tools such as analysis software, automated management systems, and market forecasting platforms to make smarter, more accurate decisions.

Core Types of Property Investment Strategies

Buy and Hold Strategy

The buy-and-hold approach involves purchasing a property and holding it long-term to generate rental income and benefit from price appreciation. Investors earn profit through monthly cash flow and increased property value over time. This strategy is most effective in stable markets with strong rental demand.

Long-term investing requires an understanding of metrics such as cap rate, cash-on-cash return, maintenance costs, and vacancy risks. Many investors now rely on property analysis tools to evaluate income potential before making a purchase.

Fix and Flip Strategy

The fix-and-flip strategy focuses on buying undervalued properties, renovating them, and selling them at a higher price. This strategy demands precise budgeting for renovation costs, effective project management, and a deep understanding of local market pricing.

Modern software helps investors calculate after-repair value (ARV), estimate renovation expenses, and plan project timelines to avoid mistakes that reduce profit margins.

Short-Term Rental Strategy (Airbnb / Vacation Rentals)

Short-term rentals often generate higher income than long-term leases. Investors earn revenue through nightly rates and can adjust pricing based on seasonality, demand, or major events in the area.

Managing short-term rentals requires automated scheduling, guest communication, and dynamic pricing systems. Automation tools are essential to keep operations efficient and profitable.

Best Property Investment Tools to Support Every Strategy

DealCheck – Real Estate Analysis Tool

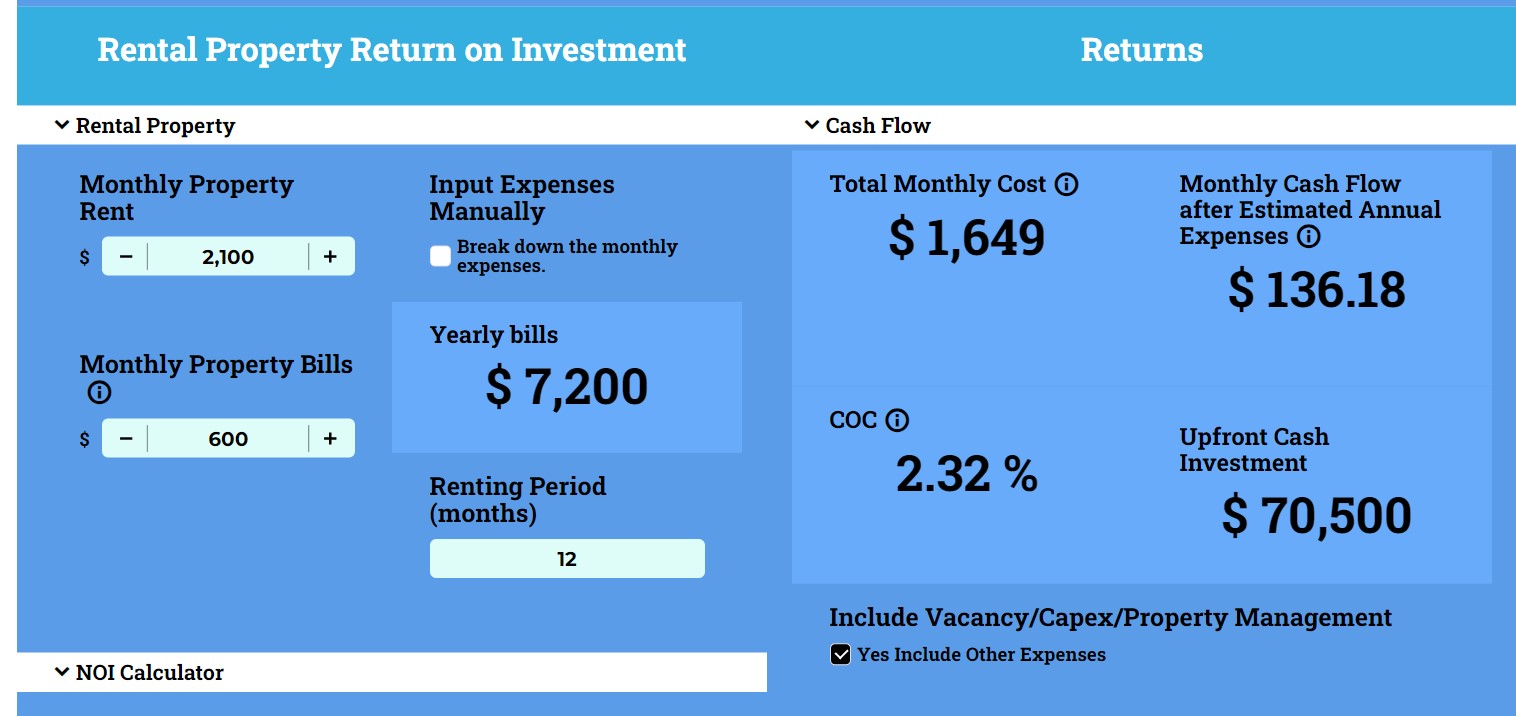

DealCheck is one of the most popular property investment calculators for analyzing rentals, flips, and BRRRR strategies. This software automates cash flow projections, tax estimates, ROI metrics, and market comparisons. Investors use it before purchasing a property to ensure financial feasibility.

The platform provides detailed calculations such as cash-on-cash return, cap rate, renovation costs, and after-repair value. It also allows users to generate professional investment reports suitable for both beginners and advanced investors.

Benefits of Using DealCheck

DealCheck helps investors avoid costly mistakes by delivering clear, detailed financial breakdowns. With accurate numbers, decisions become more rational and data-driven. It also speeds up due diligence, saving significant time during the evaluation process.

Use Cases

• Screening multiple rental properties to identify the most profitable option

• Calculating potential profit for house flipping projects

• Analyzing long-term refinancing potential for BRRRR investments

Where to Buy

DealCheck is available directly through its official platform.

BiggerPockets Property Calculator

BiggerPockets offers rental, flip, and BRRRR calculators trusted by millions of investors. The platform simplifies complex calculations and provides community insights to help validate market assumptions.

These calculators are built based on real investor experiences, making the results highly relevant and reliable.

Benefits of Using BiggerPockets Calculators

BiggerPockets provides customizable forecasting tools that update in real time. Investors can simulate loan structures, rent growth, tax implications, and market changes.

Use Cases

• Predicting long-term profitability of rental properties

• Evaluating refinancing benefits for existing properties

• Creating quick investment summaries for presentations

Where to Buy

Accessible directly through the BiggerPockets platform.

Roofstock Marketplace

Roofstock is an online marketplace offering ready-to-rent investment properties, often with existing tenants. It is ideal for buy-and-hold investors seeking passive income without the hassle of renovations or tenant placement.

Every listing includes complete financial projections, neighborhood ratings, inspection reports, and tenant payment history.

Benefits of Buying Through Roofstock

Roofstock saves time by offering turnkey properties that immediately generate income. Many homes already have tenants, allowing investors to start collecting cash flow right away. The platform also partners with trusted property managers.

Use Cases

• First-time investors seeking passive income

• Busy professionals wanting hassle-free investing

• Out-of-state investors buying in stronger rental markets

Where to Buy

Available on the main Roofstock marketplace.

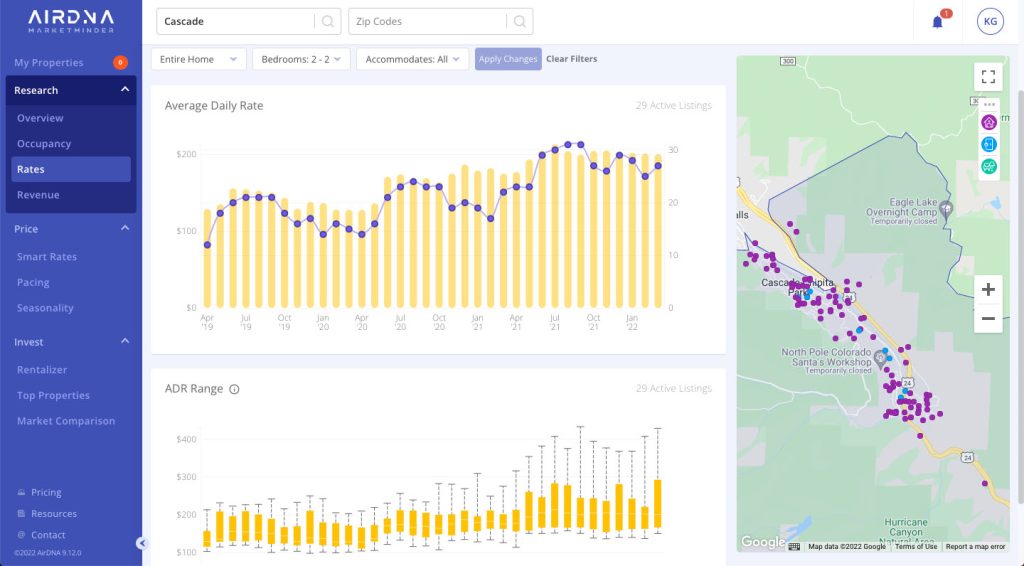

AirDNA – Short-Term Rental Market Data

AirDNA provides real-time analytics for Airbnb and VRBO markets. Investors use it to track occupancy rates, nightly pricing, expected revenue, and competitor performance.

The platform also delivers insights into seasonal trends, yearly demand, and property rankings across neighborhoods.

Benefits of Using AirDNA

AirDNS helps investors determine whether a property will perform well as a short-term rental. It also helps existing hosts optimize daily pricing for maximum revenue.

Use Cases

• Identifying top cities for short-term rental profitability

• Calculating break-even points for vacation rental investments

• Setting dynamic nightly rates based on real-time demand

Where to Buy

Available through the official AirDNA website.

Stessa – Rental Property Management Software

Stessa is a rental property management and accounting platform. It automates expense tracking, income reporting, tax preparation, and property performance dashboards.

It is ideal for investors with multiple rental units who need well-organized financial reporting.

Benefits of Using Stessa

Stessa saves time by automating bookkeeping processes. Financial data stays organized, making tax filing and long-term planning easier.

Use Cases

• Tracking monthly rental income across multiple units

• Logging renovation and maintenance expenses

• Creating financial reports for refinancing or selling

Where to Buy

Accessible directly through the Stessa platform.

Choosing the Best Property Investment Strategy for ROI

Aligning Strategy with Financial Goals

Your chosen strategy must align with your financial objectives. If your goal is passive income, buy-and-hold is ideal. For faster profit, fix-and-flip is more suitable. Meanwhile, short-term rentals provide the highest yields but require more intensive management.

Using Technology to Improve Accuracy and Reduce Risk

Modern investors rely heavily on software to reduce human error. Tools like DealCheck, BiggerPockets, Stessa, and AirDNA improve decision accuracy through detailed analysis and data-driven forecasting.

FAQs

1. What is the best property investment strategy for beginners?

The buy-and-hold strategy is generally the best for beginners because it provides stable income and long-term appreciation while allowing new investors to learn property and financial management gradually.

2. Are short-term rentals more profitable than long-term rentals?

Short-term rentals typically generate higher income, but they require more complex operations, such as guest management, cleaning, and dynamic pricing adjustments.

3. Which tool is the most important for real estate investors?

DealCheck is widely considered one of the most valuable tools because it simplifies in-depth property analysis before purchase.